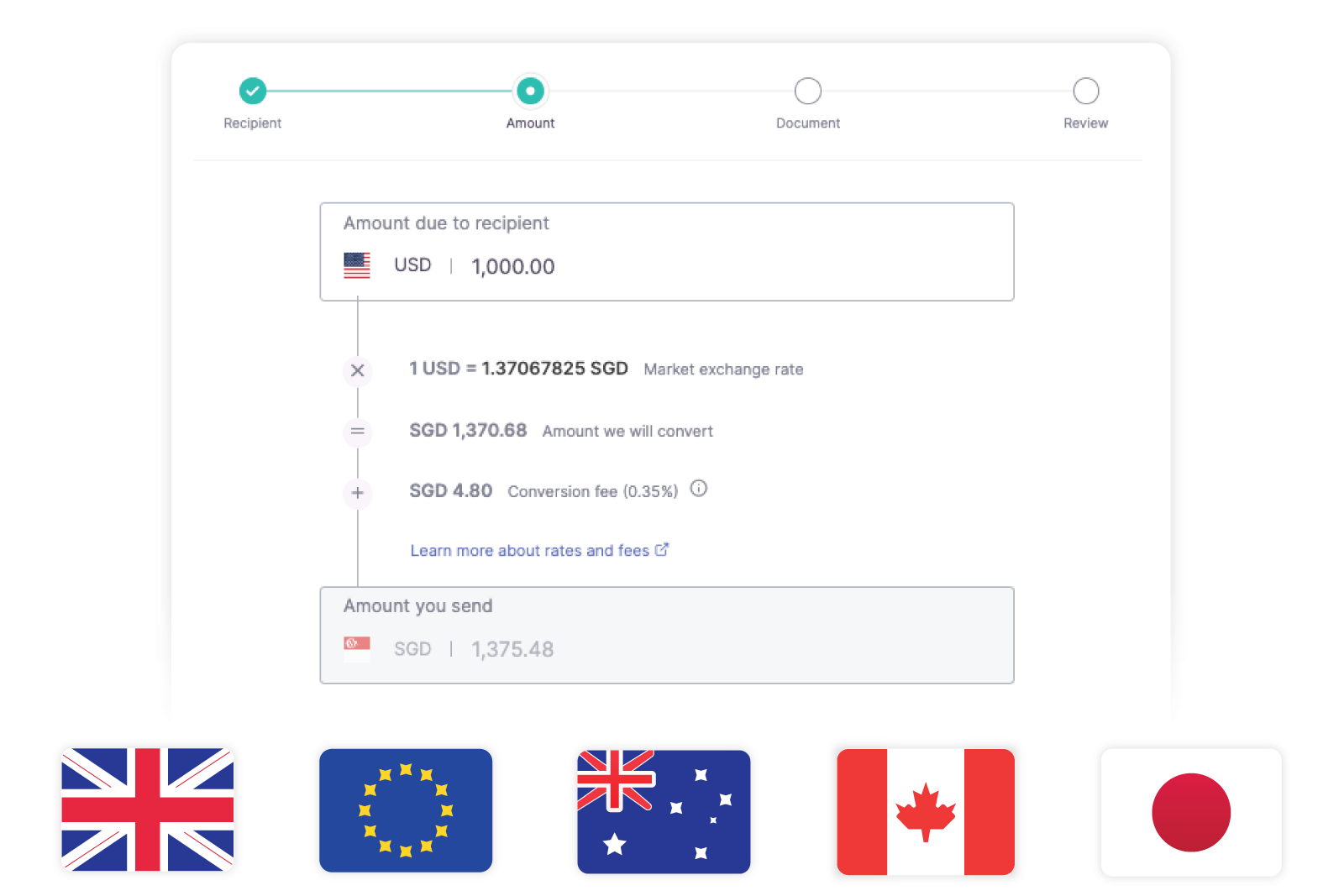

Best exchange rates and transfer fees to pay overseas

Why pay more when you can pay less? Enjoy real market exchange rates with no hidden markup and lower transfer fees

Earn up to 1.6 miles per dollar or 5% cashback* when you shift your international payments onto your credit card using CardUp.

Use promo code [PromoCode]** and enjoy 1.9% (U.P. 2.6%) card processing fee.

Enjoy over 76% lower cost compared to others

Here's how much it costs to pay a 50,000 USD invoice

.png)

.png)

- Exchange rates as of 11 August 2022. View the updated rates on our calculator above.

- The credit card above earns miles at 1.5 miles per dollar. Rewards are also earned on the CardUp fee.

- The reduced conversion fee offer for bank transfers is valid until 31 December 2023

- We ensure that all associated fees are presented upfront to you - no hidden markups or fees.

Rewards beyond borders

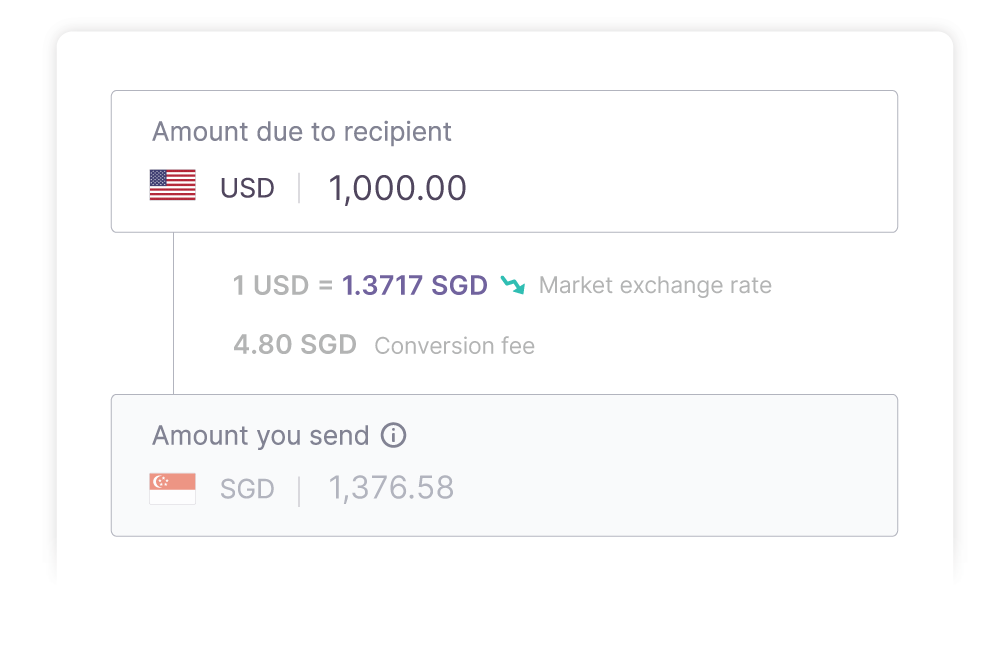

Low rates and fees

Best exchange rates for USD, EUR, GBP & more. Plus, no fees by bank transfer or extra low fees by card

Transparent and secure

See breakdown costs presented upfront - no hidden markup. Platform has bank-standard security.

Limitless card benefits

Fly beyond with earned miles or get cashback savings with your credit card. Plus, pay only when your card bill is due almost 2 months later.

Track all at one place

Never lose sight of your payments, no matter how far. View all past and upcoming local and overseas payments in one dashboard.

Best exchange rate and much lower transfer cost

Why pay more when you can pay less?

Pay with real market exchange rates (no hidden markup) and fees that are over 76% cheaper than banks and other remittance providers.

Complete transparency to save your time and money

No hidden markup or fees. All charges are presented upfront so you will know exactly what you are paying for.

Pay by credit card at the lowest card fee

Unlock the full benefits of your credit card – whether it is to rack up air miles for your next trip or earn cashback savings. You'll also get to defer payments by up to 2 months for better cash flow.

.png)

![[L+P] SG B2B Dashboard Make-1](https://www.cardup.co/hubfs/Singapore/L%20P%20SG%20B2B%20Dashboard%20Make-1.png)

Save more with our limited-time offers

- New users: 1.3% (2.6%) CardUp fee for credit card payments

- All users: 0% CardUp fees and reduced conversion fee for bank transfer

By submitting this form, you agree to receive promotional emails from CardUp. You have the option to opt-out at any time. For more details refer to our Privacy Policy

Get started and pay abroad

in less than 10 minutes

1. Get started

Sign up for a free account and verify your identity in less than 3 minutes with CorpPass.

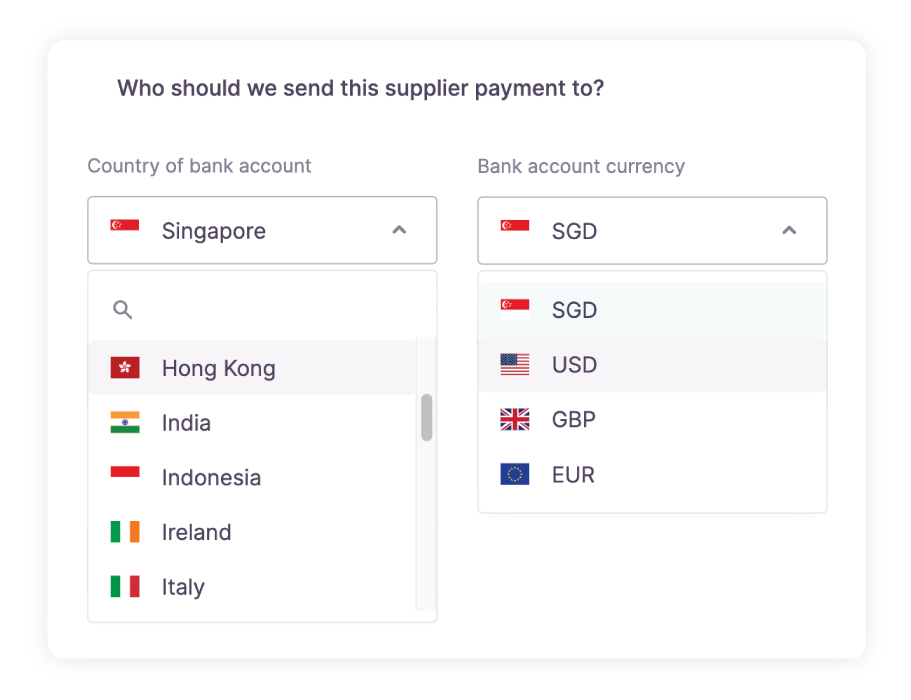

2. Set up payment

Create a Supplier payment, enter the payment amount and recipient's bank details, and attach your invoice.

3. Select payment method

Choose credit card or bank transfer and hit "Create Payment". It is really that simple!

Start paying around the world by credit card

at low rates, even where cards are not accepted

Make payments to 70+ countries...

![]() Algeria

Algeria

Andorra

Angola

Anguillar

![]() Argentina

Argentina

Armenia

Aruba

![]() Australia

Australia

![]() Austria

Austria

Azerbaijan

![]() Bahrain

Bahrain

![]() Bangladesh

Bangladesh

![]() Belgium

Belgium

Bolivia

Bosnia and Herzegovina

![]() Brazil

Brazil

British Virgin Islands

Bulgaria

![]() Cambodia

Cambodia

![]() Canada

Canada

Chile

![]() China

China

Colombia

Costa Rica

Croatia

Cyprus

![]() Czech Republic

Czech Republic

![]() Denmark

Denmark

Dominica

![]() Dominican Republic

Dominican Republic

East Timor

![]() Ecuador

Ecuador

![]() Egypt

Egypt

Estonia

Faroe Islands

Fiji

Finland

![]() France

France

![]() French Guiana

French Guiana

French Polynesia

French Southern Territories

![]() Georgia

Georgia

![]() Germany

Germany

Greece

Greenland

Grenada

Guernsey

Guyana

Honduras

![]() Hong Kong

Hong Kong

![]() Hungary

Hungary

Iceland

![]() India

India

![]() Indonesia

Indonesia

![]() Ireland

Ireland

Isle of Man

![]() Israel

Israel

![]() Italy

Italy

![]() Japan

Japan

Jersey

Kazakhstan

Kosovo

![]() Kuwait

Kuwait

Kyrgyzstan

Latvia

Liechtenstein

Lithuania

Luxembourg

Macedonia

![]() Malaysia

Malaysia

![]() Maldives

Maldives

![]() Malta

Malta

![]() Martinique

Martinique

Mauritius

![]() Mayotte

Mayotte

![]() Mexico

Mexico

Monaco

Montenegro

Namibia

![]() Nepal

Nepal

![]() Netherlands

Netherlands

New Caledonia

![]() New Zealand

New Zealand

Nigeria

![]() Norway

Norway

![]() Oman

Oman

Paraguay

Peru

![]() Philippines

Philippines

![]() Poland

Poland

![]() Portugal

Portugal

Puerto Rico

![]() Qatar

Qatar

![]() Reunion

Reunion

![]() Romania

Romania

![]() Saint Barthelemy

Saint Barthelemy

Saint Lucia

![]() Saint Martin

Saint Martin

![]() Saint Pierre and Miquelon

Saint Pierre and Miquelon

San Marino

![]() Saudi Arabia

Saudi Arabia

![]() Serbia

Serbia

Seychelles

![]() Singapore

Singapore

Slovakia

Slovenia

South Africa

![]() South Korea

South Korea

![]() Spain

Spain

Sri Lanka

![]() Sweden

Sweden

![]() Switzerland

Switzerland

![]() Taiwan

Taiwan

Tajikistan

![]() Thailand

Thailand

![]() Tunisia

Tunisia

![]() Turkey

Turkey

![]() United Arab Emirates

United Arab Emirates

![]() United Kingdom

United Kingdom

![]() United States

United States

Uruguay

![]() Vietnam

Vietnam

![]() Wallis and Futuna

Wallis and Futuna

Zambia

...in 20+ currencies

![]() Australian dollar

Australian dollar

![]() Bangladeshi taka

Bangladeshi taka

![]() British pound

British pound

![]() Canadian dollar

Canadian dollar

![]() Chinese yuan

Chinese yuan

![]() Euro

Euro

![]() Hong Kong

Hong Kong

![]() Indian rupee

Indian rupee

![]() Indonesian rupiah

Indonesian rupiah

![]() Israeli new shekel

Israeli new shekel

![]() Japanese yen

Japanese yen

![]() Malaysian ringgit

Malaysian ringgit

![]() Mexican peso

Mexican peso

![]() Napalese rupee

Napalese rupee

![]() New Zealand dollar

New Zealand dollar

![]() Norwegian krone

Norwegian krone

![]() Philippine peso

Philippine peso

![]() South Korean won

South Korean won

![]() Swedish krona

Swedish krona

![]() Swiss franc

Swiss franc

![]() Thai baht

Thai baht

![]() Turkish lira

Turkish lira

![]() US dollar

US dollar

![]() Vietnamese dong

Vietnamese dong

Have questions about making international payments?

Whom can I pay internationally?

Currently, we support several types of overseas invoices like goods purchased, professional services, business expenses, technical services, consulting services etc.

All overseas invoices need to be paid for via the 'Supplier Payments' payment category in your CardUp account.

What credit cards are accepted?

Currently, all Singapore-based Visa, Mastercard and Unionpay credit cards are accepted.

American Express cards are not accepted for overseas payments at the moment.

What are the fees?

CardUp ensures that any fees or charges incurred are displayed transparently and presented upfront. To view the different types of fees, visit our FAQ here.

How does using my credit card free up my cash flow for 2 months?

When you use a credit card to make a payment, your recipient still gets paid on time and by bank transfer. However, you will get to defer the actual outflow of your cash until your card bill is due up to 2 months later. This lets you gain an extended payment term, and you can use that cash for other more important operations first.

Will I earn rewards on my credit card for payments made through CardUp?

All local and international payments made using a Singapore-issued card on your CardUp-registered account are eligible for the base earn rate* of miles (up to 1.6 miles per dollar), points or cashback on most credit cards.

This includes all of these popular credit cards listed here.