Free up more cash instantly

Maximise your credit card limits and free up working capital by shifting payments to your cards. Optimising cash flow has never been easier.

Thousands of businesses are already using CardUp to optimise cash flow

"With CardUp, I’m able to minimise cash flow gaps and keep my business running without disruption.'

Dr Chong

Managing Director | Aviation Virtual

"CardUp's unique platform helps optimise cash flow, especially in a small team to keep operations going smoothly."

Jeremy Tan

Team Lead | Paula's Choice

"I'm now able to optimise working capital for my business at a flexible and affordable rate. It also helps us process our payments timely."

Nina Alag Sure

CEO | X0PA AI

"A clear value-add is the ability to access interest-free credit - this has been pivotal in helping drive healthy working capital ratios."

Jerrold Quek

Chief Operating Officer | Far Ocean Group

.png)

Heading Text

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer eget hendrerit metus. Curabitur a diam ultricies, vulputate quam non, aliquet sem. Nulla nisi enim, mollis ut tempus et, pulvinar eu urna. Mauris commodo turpis elit, sed dictum orci pharetra ac. Vivamus pellentesque risus eu augue gravida vestibulum. Nullam aliquet, magna faucibus tristique cursus, lacus augue venenatis elit, non gravida mi orci in velit. Quisque non hendrerit ex, in faucibus diam.

How does using your card free up cash on hand?

Receive invoice

Sam receives an invoice from his supplier with a 30-day payment term

Pay recipient

He charges the invoice amount to his credit card via CardUp, and his supplier receives the payment on time via a bank transfer

Delay payment

His credit card statement arrives at the start of the next month, and is only due 30 days later. Sam pays off his statement when it is due, extending his invoice payment terms by up to 2 months, interest-free!

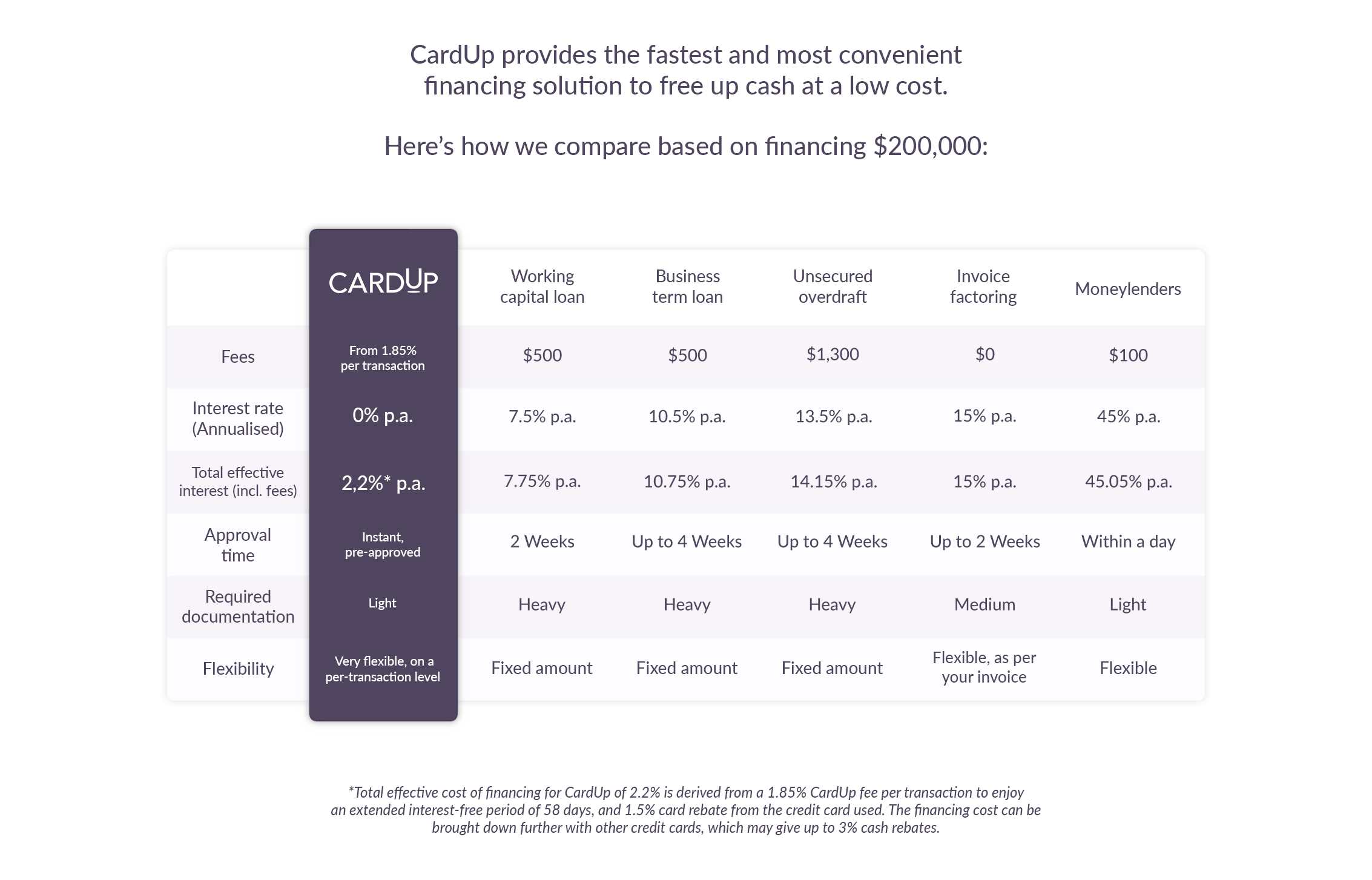

See your cost of financing when you use CardUp

CardUp provides the fastest and most convenient financing solution to free up cash at a low cost. See how we compare against other popular financing options such as loans, overdrafts and more.

CardUp supports cards from all major banks and issuers

Have questions about freeing up cash flow CardUp?

How does using my credit card free up my cash flow for 2 months?

When you use a credit card to make a payment, your recipient still gets paid on time, while you defer the actual outflow of your cash until your card bill is due. This lets you gain up to two months of extended payment terms.

What business payments can I make with CardUp?

Our platform lets you shift payments currently made by cash, cheque or bank transfers onto your credit cards, even where cards are not accepted. These include payments such as payroll, supplier invoices (including business services), rent, corporate taxes and more.

You can view the full list of accepted payments here.

What fees do CardUp charge?

CardUp charges a processing fee from 1.85% for your business payments.

Our fee covers the processing costs to the card-issuing banks and network providers for each transaction made. The fee also ensures our platform remains secure for your everyday use.

Optimise your working capital today

Join the thousands of business who are fully utilising their credit card lines with CardUp

More than just about freeing up cash